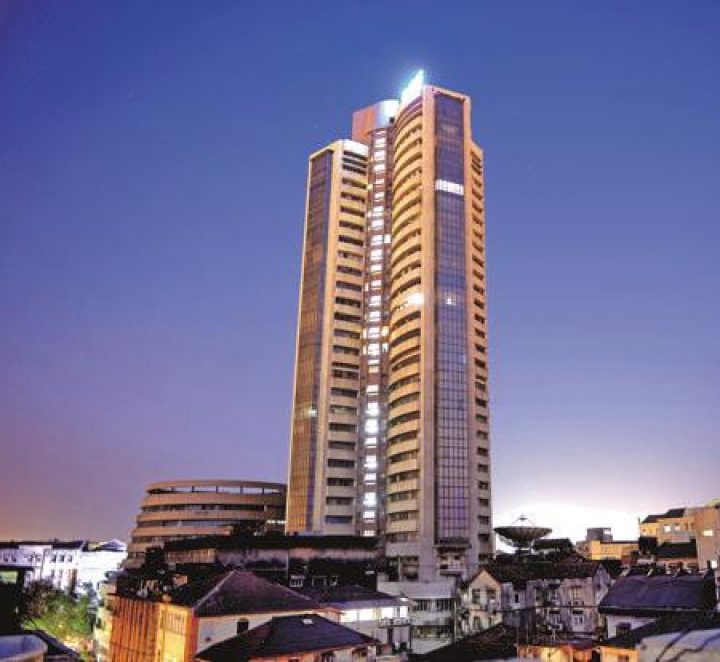

Sensex, Nifty trade lower amid caution ahead of RBI decision

- 05.06.2018

- Indian Stock Market

- 0

BSE Sensex trades lower by 50 points, while the Nifty 50 trades near 10,600. Here are the latest updates from the markets

Benchmark indices BSE Sensex and NSE’s Nifty 50 traded lower for the second day on Tuesday as investor turned cautious ahead of the Reserve Bank of India’s policy statement on Wednesday. Of the 15 economists surveyed by Mint, 11 expect the central bank to keep the repo rate unchanged at 6%. Moreover, most Asian markets declined after the previous day’s rally. However tech-inspired gains in US stocks supported broader sentiment. The Indian rupee was trading little changed against the US dollar.

9.50 am IST

RCom shares down 5%

Shares of Reliance Communications Ltd fell 5% to Rs15 after the company said it will not pay interest on NCD to JLF until restructuring process ends.

9.28 am IST

Sugar stocks rise over report of Rs8,00 crore govt package

Sugar stocks gains after a report that the centre is going to announce a Rs8,000 crore package to help sugar mills clear pending payments to sugarcane farmers.

Bajaj Hindusthan Sugar Ltd rose 4%, Balrampur Chini Mills Ltd 3%, Shree Renuka Sugars 0.3%, Mawana Sugars Ltd 4%, Dwarikesh Sugar Industries Ltd 3%, Avadh Sugar & Energy Ltd 5%.

9.25 am IST

Biocon shares jump 7%

Biocon Ltd shares jumped 7% to Rs695 after the company said Mylan won approval for Neulasta Biosimilar.

9.20 am IST

Rupee trades flat against US dollar ahead of RBI policy review

The Indian rupee was trading little changed against the US dollar on Tuesday as traders turned cautious ahead of the Reserve Bank of India’s bi-monthly policy outcome.

The rupee was trading at 67.11 against the US dollar, up 0.01% from its previous close of 67.11. The currency opened at 67.08 a dollar. The 10-year bond yield stood at 7.86% from its Monday’s close of 7.876%. Bond yields and prices move in opposite directions.

So far this year, the rupee has weakened 4.83%, while foreign investors have sold $225.90 million and $4.45 billion in equity and debt markets, respectively.

source: livemint.com

Categories: Indian share market, Indian sharemarket news, Indian Stock exchange, Indian Stock Market, Indian Stock Pick, Primary Market

Comments

Sorry, comments are closed for this item.