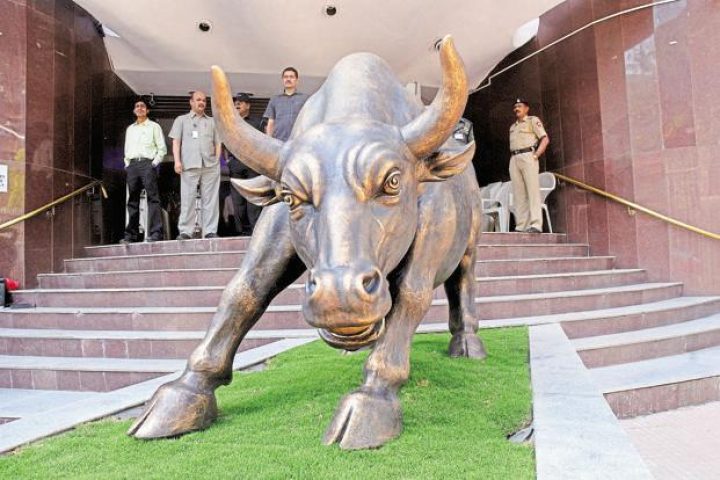

Market Live: Sensex, Nifty rise, Infosys jumps as Nandan Nilekani likely to re-join, banking stocks surge

Mumbai: The Sensex and Nifty traded higher on Wednesday, on track for a second straight gain, but were confined to a narrow range for want of fresh triggers after a tepid results season. “Average first-quarter corporate results and a lack of fresh triggers will see markets remain range-bound in the near to medium term,” said R.K. Gupta, managing director at Taurus Asset Management.

Banks were among the top gainers with private-sector lender ICICI Bank rising 1.3%. Among state-run peers Allahabad Bank and Bank of India rose over 2.5% each.

Realty stocks also gained with DLF climbing nearly 8% after it said an audit committee would review the status of the proposed sale of compulsorily convertible preference shares to an affiliate of Singapore sovereign wealth fund GIC. Shares of Fortis Healthcare Ltd rose as much as 7.3% following a block deal worth Rs605.9 million on Tuesday, while Goldman Sachs initiated coverage with a “buy” rating.

IT stocks were among the day’s decliners with Tech Mahindra Ltd falling over 1.5%, though Infosys Ltd was on track for its first gain in four sessions. However, institutional interest has been steadily rising with domestic buyers picking up shares worth a net Rs435 crore on Tuesday, data on the NSE showed. Here are the latest updates.

■ 2.00pm: Public sector banks gains after Bloomberg reported that the government may approve plans for more mergers among state-owned banks at a cabinet meeting later Wednesday. Allahabad bank rose 4%, Union Bank of India 3.2%, Bank of India 3.2%, Syndicate Bank 3%, Oriental Bank of Commerce 3%, Andhra Bank 3%, Punjab National bank 2.5%, Canara Bank 2%, IDBI Bank 2%, Bank of Baroda 1%, State Bank of India 1%.

■ 1.40pm: Dr Reddy, Infosys and Bharti Airtel are among top gainers with profits to the tune of 2.36%, 2.03, and 1.73%, respectively.

■ 1.00pm: Jaypee Infratech Ltd fell 5% to Rs13.85 after Supreme Court Chief Justice J.S. Khehar said it will hear home buyers’ plea on Thursday. Jaiprakash Power Ventures Ltd fell 4.3%, Jaiprakash Associates Ltd 1%.

■ 12.40pm: Infosys rises 2.63% to Rs900 after CNBC TV reported that Nandan Nilekani is likely to head Infosys for now.

■ 11.59am: BSE Sensex trades higher by 152 points, or 0.49%, to 31,444, while the Nifty 50 rises 42 points, or 0.43%, to 9,808. BSE telecom index rises 1.3%, BSE realty index rises 2.73%, and BSE finance rises 1.01%.

■ 11.24am: BSE Sensex trades higher by 146 points, or 0.47%, to 31,438, while the Nifty 50 rises 40 points, or 0.41%, to 9,805.

■ 10.12am: Major gainers on BSE are Adani Ports, Dr Reddy, Bharti Airtel, Tata Motors, and ICICI Bank as the shares rise to the tune of 2.19%, 2.10%, 1.64%, 1.26%, and 1.02%, respectively.

■ 9.31am: BSE Sensex trades higher by 115 points, or 0.37%, to 31,407, while the Nifty 50 rises 37 points, or 0.38%, to 9,803.

■ 9.30am: DLF Ltd rose 3% to Rs183 after the company said its board would meet on 25 August for review the status of the proposed sale of compulsorily convertible preference shares to GIC.

■ 9.29am: Adani Ports shares rise 2% to Rs381.95 after brokerage firm Morgan Stanley initiated coverage with overweight and increased its target price by 25% to Rs 471 a share.

■ 9.28am: Fortis Healthcare Ltd rose 4% to Rs147.30 after Rekha Jhunjhunwala, wife of investor Rakesh Jhunjhunwala, bought 45 lakh shares or 0.9% stake in the company via bulk deal on Tuesday at Rs134.65 per share, data on the National Stock Exchange (NSE) of India showed.

■ 9.27am: Balaji Telefilms Ltd rose 3% to Rs158.15 after the company said its board has approved allotment of 2.52 crore equity shares to Mukesh Ambani-led Reliance Industries Ltd (RIL) for a total consideration of Rs413.28 crore.

■ 9.25am: Indo Count Industries Ltd rose 2.2% to Rs102.50 after the company denies rejection of orders by its customers.

■ 9.20am: Ashima Ltd rose 3.5% to Rs23.55 after the company said, in a notice to BSE, that it sold surplus land for a consideration of Rs160.89 crore.

■ 9.15am: Infosys Ltd fell 0.01% to Rs877.05. Days after the board of Infosys Ltd blamed N.R. Narayana Murthy for Vishal Sikka’s decision to step down as chief executive officer (CEO), the founder and former CEO of Infosys is set to address investors and assuage concerns, amid a broader tussle between the board and the founders that has severely dented investor confidence in the company and wiped out thousands of crores in market value.

In a highly anticipated address since Friday’s press conference announcing Sikka’s departure, Murthy will be speaking to investors at a conference hosted by brokerage firm Investec India.

■ 9.10am: The 10-year bond yield was at 6.542%, compared to its previous close of 6.535%. Bond yields and prices move in opposite directions.

■ 9.05am: The rupee opened at 64.05 a dollar. At 9.05am, the rupee was trading at 64.07 a dollar, up 0.07% from its Tuesday’s close of 64.11.

■ 9.00am: Asian currencies were trading higher. South Korean won was up 0.40%, Philippines peso 0.17%, Taiwan dollar 0.13% and China offshore 0.07%. However, Japanese yen was down 0.08%.

Source:livemint.com

Categories: Stock Market

Sorry, comments are closed for this item.