Two years since demonetisation, these 44 stocks have more than doubled investor wealth

- 08.11.2018

- Indian Stock Market

- 0

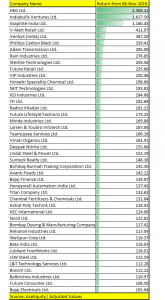

Individual stocks that more than doubled investor wealth in the last two years in the S&P BSE 500 index include names like HEG, Indiabulls Ventures, Graphite India, V-Mart Retail among others.

The sudden announcement of demonetisation exactly two years ago came as a surprise to most. While the jury is still out on whether it was successful in achieving its goals, such as weeding out black money, several stocks have done quite well since.

Some, analysts believe, were direct beneficiaries of changes brought on by demonetisation.

Over the last two years, the Sensex has rallied 27 percent. Over the same period, as many as 40 stocks more than doubled investors’ wealth.

The BSE’s market capitalisation rose from Rs 109.6 lakh crore on November 8, 2016 to Rs 141.67 lakh crore — wealth creation of over Rs 30 lakh crore.

Individual stocks that more than doubled investor wealth in the last two years in the S&P BSE 500 index include names like HEG, Indiabulls Ventures, Graphite India, V-Mart Retail, Venky’s India, Adani Transmission, Future Retail, VIP Industries, NIIT Technologies, KEI Industries, ITI, Radico Khaitan, Sterlite Technologies, Rain Industries, Phillips Carbon.

In the S&P BSE Small-cap index, as many as 60 stocks more than doubled investors’ wealth in the last two years which include names like Balkrishna Industries, Bajaj Electricals, Jubilant FoodWorks, Bata India, Vaibhav Global, Shakti Pumps, NIIT Technologies, Radico Khaitan, Usha Martin etc. among others.

In the S&P BSE Mid-cap index, four stocks which have more than doubled investors wealth include names like Biocon, JSW Steel, Jindal Steel & Power, and Adani Enterprises.

Some of the companies that have generated superior returns over the last two years have witnessed a change in fundamentals, said Atish Matlawala of SSJ Finance & Securities told Moneycontrol.

He pointed to changes such as pollution concerns in China, which has driven greater investments into India, or rising income in Tier 2 and 3 cities, and

higher aspirations of rural India. Others include opening for previously unbanked population, a development partially linked to demonetisation.

The economy has been hit by adverse news on rupee, oil, global yields, bank NPAs and recently, the liquidity issues in the NBFC sector.

These issues reflected in equities as well, with increasing volatility also affecting the well-performing stocks.

“Macros have witnessed overwhelming headwinds, all within the span of the past six-nine months,” Dinesh Rohira, Founder & CEO, 5nance.com told Moneycontrol.

He added that while economic factors were aiding the companies that have performed well over the past two years, some caution is warranted now.

“Several stocks on the list (of well-performing stocks since demonetisation) are still backed by robust business models and outstanding future prospects, some are names where it is prudent to book profits at current level,” he said. “There are where fundamentals have deteriorated or where this a corporate governance issue”.

source: moneycontrol.com

Categories: BSE Sensex, Free watch sharemarket news, Indian share market, Indian sharemarket news, Indian Stock Market, Mutual Funds, sharemarket top news

Comments

Sorry, comments are closed for this item.