Worst October in 9 years: Investors lose Rs 6 lakh crore in BSE cos, 18 stocks fall 20-60%

- 01.11.2018

- Indian Stock Market

- 0

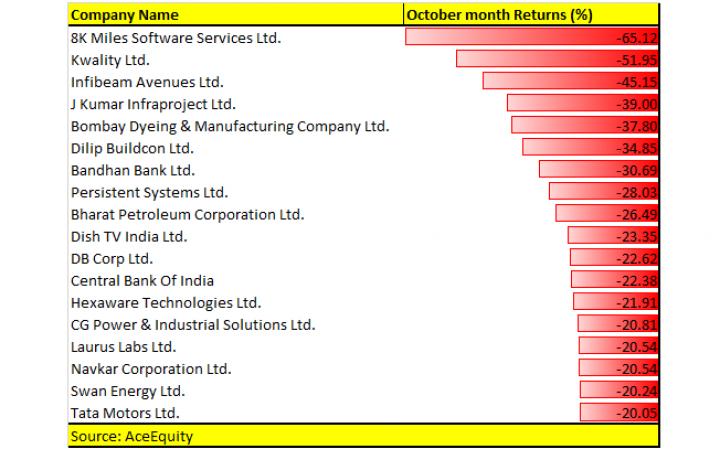

Nearly 60% or 298 S&P BSE500 companies gave negative returns,18 of which fell 20-60% in just 1 month

After witnessing a fall of nearly 1,800 points, or 4.93 percent, on the Sensex and 544 points on the Nifty50, investors must have taken a sigh of relief as it turned out to be the worst October since 2009.

The S&P BSE Sensex fell the most in 2008 when it dropped 25 percent in a single month, followed by 7.2 percent dip in the year 2009.

Weak macros, volatility in domestic currency, liquidity woes plaguing the NBFC sector, muted earnings from India Inc., persistent selling by foreign investors, trade war woes and the rise in crude oil prices dented investor sentiment.

The positive take away from the month of October is that market might have made a short-term bottom around 10,000 on the Nifty and 33,700 on the Sensex.

The Nifty50 bounced back after hitting a low of 10,004 on October 26, and Sensex, too, saw a reversal after hitting a low of 33,776 on the same day.

Investors lost more than Rs 6 lakh crore in terms of market capitalisation on the BSE-listed companies in October. The m-cap of companies on BSE stood at Rs 144.86 lakh crore on September 28 and on on October 31, it was Rs 138.45 lakh crore.

Tracking the sentiment, nearly 60 percent, or 298 companies, of the S&P BSE 500 gave negative returns and out of those, 18 fell 20-60 percent in just 1 month, including 8K Miles, Kwality, Infibeam Avenues, Bombay Dyeing, Dilip Buildcon, Bandhan Bank, Persistent Systems, Tata Motors.

Historically, October is known as “the jinx month” in the US and also globally due to a number of major sell-offs that have occurred in the past during the month.

There were “crashes in 1929 and 1987”, along with “the 554-point drop on October 27, 1997″, back-to-back massacres in 1978 and 1979, Friday the 13th in 1989, and the meltdown in 2008, HDFC Securities highlighted in a report.

However, analysts advise investors to not panic and use dips to accumulate quality stocks. Selective mid & small-cap stocks could turn out to be wealth creating ideas in the near future.

“It’s part and parcel of investing; take in your stride. Earlier bear markets make this one look like a walk in the park. Do not panic and liquidate your MFs/stock portfolio. Bear markets are shorter than bull markets and one needs to ride out this one,” Dipan Mehta, Director, Elixir Equities told Moneycontrol.

“Over the next 2-3 years, wealth will be created in select small and mid-cap stocks. Stocks with high weightage in Sensex and Nifty will find it challenging to eke our earnings growth due to high base effect and downturn in the industry cycles they are present in,” he said.

Broader market managed to buck the trend when compared to benchmark indices in October. The S&P BSE smallcap index fell 1.59 percent while the S&P BSE midcap index fell just 1.02 percent.

source: moneycontrol.com

Categories: BSE Sensex, How To Make money, Indian share market

Comments

Sorry, comments are closed for this item.